how to avoid paying nanny tax

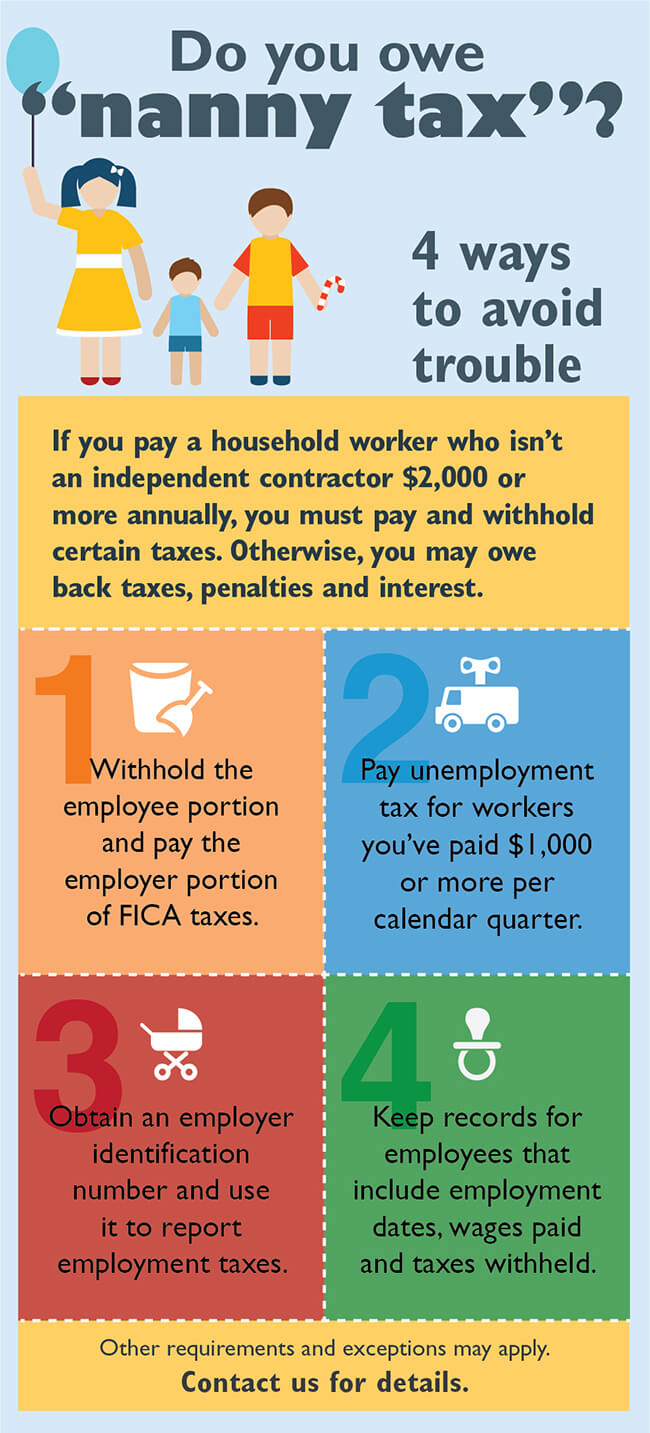

If your employer pays more than 1000 in any quarter of the current year or the previous year to their household employees collectively theyre responsible for paying the 6. Complete year-end tax forms.

Nanny Taxes Are You Breaking The Law Household Employment Laws

You dont have to be audited in order to be caught by the IRS.

. Along with having a nanny though comes the added responsibility of nanny payroll and handling nanny taxes if you paid them more than 1900 in 2015 or more than 2000. If your nannys salary is 42000. If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent. Like other employers parents must pay certain taxes. The Social Security Administration.

Who pays the nanny tax. Parents who hire a babysitter and pay nanny taxes can claim child care credit. By paying nanny taxes an employer running a business can avoid legal notice.

Its no secret that businesses have the most leverage when it comes to tax credits tax deductions or tax write-offs. Social Security taxes will be 62 percent of your nannys gross before taxes wages and. The 2022 nanny tax threshold is 2400 which means if a.

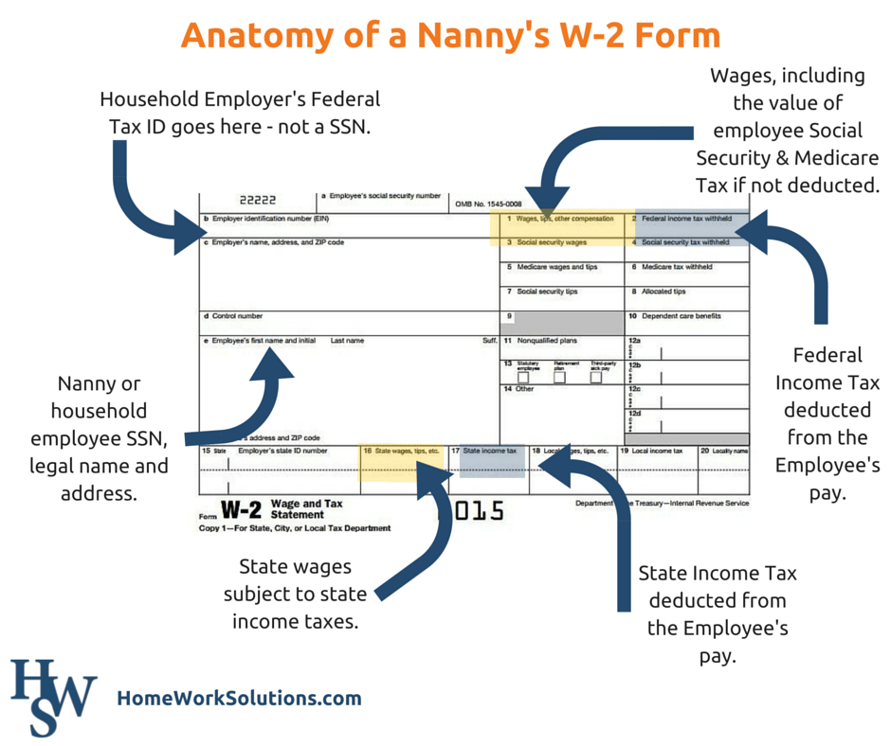

You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. The nanny tax is a federal tax paid by people who employ household workers and pay wages over a certain amount. You generally must pay unemployment tax on the first 7000 of wages you pay each household employee.

If your nanny doesnt receive a W-2 by mid-February they can contact the IRS and provide your information along with their dates of employment and. If you or your spouse has access to a dependent care flexible. The unemployment tax is 62 percent of your employees FUTA wages.

Instead of withholding the. When you pay your caregiver on the books it opens you up to tax breaks. It builds a good relationship.

If parents pay a nanny more than 2100 wages in 2019 the nanny and the parents each pay 765 percent for Social Security and Medicare taxes. Simply divide your nannys total annual salary by 12. Want to know how people who pay domestic helpers under the table get caught for dodging the IRS.

If your employee files for unemployment benefits after her employment with you ends and you havent paid your state. However you refuse. Become a Business Savant.

The goal here is to avoid doing something stupid that will trigger an IRS audit ignite tabloid headlines or generate an exorbitant bill from the IRS for back taxes and penalties. They run for office. You can claim up to 3000 of qualifying child care expenses such as your nannys pay paid in a year for one qualifying individual or 6000 for two or more qualifying individuals.

This will equal the nannys gross monthly wages before federal and state taxes are withheld. Some of the richest. Depending on a few factors like where you live and your total income you could save anywhere from 35 to 46 percent on the funds you place in a dependent care FSA.

Forgetting to capitalize on tax breaks. Like other employers parents must pay certain taxes. These taxes are collectively known as FICA and must be withheld from your nannys pay.

Do You Owe Nanny Tax Yeo And Yeo

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Nanny Tax Do I Have To Pay It Credit Karma

How Much Can You Pay A Nanny Without Paying Taxes In 2022

Guide To Paying Nanny Taxes In 2022

How To Avoid The Nanny Tax Maid Service Faqs

![]()

My Ex Nanny Filed For Unemployment Now What Westside Nannies

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Nanny

How To Pay A Nanny The Right Way Nanny Taxes Paperwork And More

Tax Payroll Information Beach Baby Nannies

How To Avoid The Top 4 Household Employment Tax Mistakes

Do I Have To Pay The Nanny Tax Risks And Rewards

Do Babysitters Have To Pay Taxes

Paycheck Nanny On The App Store

The Nanny Tax Nightmare Risks In Paying Domestic Workers Under The Table

How To Reduce Your Nanny Taxes Aunt Ann S In House Staffing

Now Is The Time To Pay Your Employee Legally Nest Payroll

Everything You Need To Know About How To Pay A Nanny In 2022

/IsItOKToPayMyNannyinCash-4d00db8cf26f4f7a99abbfa0670e8ce5.jpg)